Advanced Market’s Corner: Key Employee Incentive Plans

Welcome to Allegis Advanced Market’s Corner. We thought we should try something a little different since 2020 tossed everything normal out the door. Financial planning seems to have jumped to the front of clients’ honey-do lists or “get stuff in order” goals. There have been tax changes, re-prioritization of what matters most, and changes in personal and business momentum.

In the Advanced Markets department of Allegis, we don’t have the opportunity to talk with everyone who affiliates with Allegis. We often field calls from financial advisors or agents across the country with various questions that they encounter. Sometimes these calls are referred from the different sales desks within Allegis or directly from the advisors themselves. Our goal is to provide advisors with the resources they need to service new and old clients as complex concepts or opportunities arise.

This first quarter there seems to be a trend with these questions, as the topic most asked is about employee retention. The term “Deferred Comp” is typically associated with this concept. I find this a bit unique considering the pandemic and impact it has had on the economy. My assumption is that many business owners realize the value of their key employees and want to ensure their loyalty to protect both parties.

Here is the question that is most often asked. “I have a client who wants to keep a key employee and isn’t there a deferred comp plan that keeps the employee from leaving?” The simple answer is yes. We have quite a few different options and I thought I would share a couple of those here.

The types of options available depends on the type of operating entity that is being used. There are different options for C-corps than there are for S-Corps & LLCs (Partnerships). This is typically the first data gather question asked by the advanced markets team. Once we know this, we can narrow down the options available.

C-Corps

For example, a true deferred comp plan is only available through a C-Corp entity. It isn’t very often that we see C-Corps in the small to medium marketplace. A C-Corp is a taxable entity within itself. Taxable income is not “passed through” to the owners’ individual tax returns. A C-Corp plays a flat 21% tax according to the current rules. Deferred compensation arrangements provide employers with a nonqualified planning tool that rewards selected participants by helping them create financial security for retirement, death, and/or disability. These plans are typically owned by the C-Corp. This is the benefit of a C-Corp. It can hold those assets for the benefit of the employees. If this design were structured in a “pass through” entity like a S-Corp the assets would be owned by the S-Corp shareholders. There would not be a taxable benefit for the deferment.

A deferred compensation arrangement looks like this:

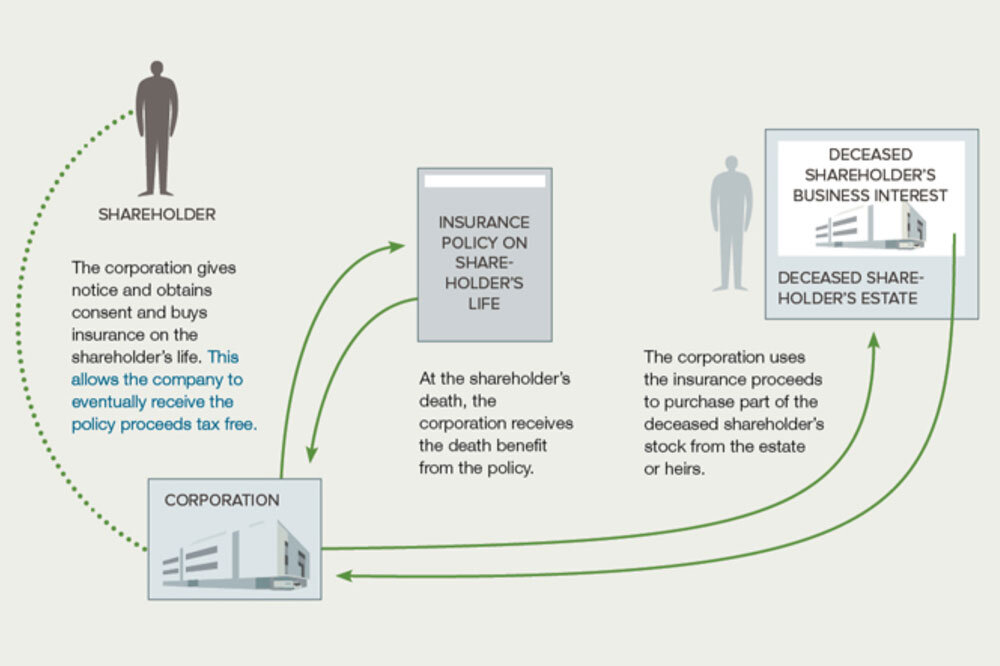

Another strategy that can be utilized with a C-Corp is called Split Dollar. There are couple different variations of split dollar, but the goal is essentially the same. There is basically a loan established between the corporation and the key employee. That loan typically pays for premium into a life insurance contract which then can be used to fit the employee’s personal objectives. The loan must be paid back to the corporation through death benefit or other means prior to the employee’s personal objectives are satisfied. These plans must all be 101(j) compliant. There are also no immediate tax deductions for the employer until the distributions are made to the employee.

S-Corps/LLCs/Pass-Through Entities

These are the most common types of entities that we see, and they often have the most flexibility with the types of plans that can be offered. There is no taxable benefit for a pass-through entity to own a deferred comp plan or split dollar. The objective is the same for these plans, but the ownership shifts to the employee. Restrictions can be put into place through an agreement to incentivize the employee to stay and maintain the excellent service they have previously provided.

The simplest executive bonus plan is often called a 162 arrangement. The employer pays a bonus each year to these selected employees, typically either in cash or in the form of premiums on life insurance policies on their lives. This arrangement is not the same as key employee insurance, which is intended to protect the business from losses resulting from the employee's death. In some cases, the employer may choose to cover the annual taxes on this bonus with an additional cash bonus to the employee.

Eventually, the policy's annual cash value will exceed the tax on the bonus and the employee may borrow or withdraw from the cash value to pay the taxes. Of course, policy loans or withdrawals will reduce the death benefit and may have tax consequences.

Since the bonus is taxed as additional compensation to the employee, the employer may deduct it in the year it is paid, provided it qualifies as reasonable compensation to the employee.

Here is a visual of a basic Executive Bonus/162 Arrangement Plan:

These plans are relatively simple to establish, and the cost can be flexible as well. We have seen plans establish with permanent coverage, term coverage, and hybrid coverage (Life+LTC).

If you have a potential client, please feel free to reach out to the Advanced Markets Department. We can supply you with sample agreements, outlines, and client friendly brochures. Our goal is to be a trusted member of your team and to provide you with the resources needed to succeed. We care about your business as much as you do.

Reach out to Tyson Ferney (Director of Advanced Markets) at 801-826-2600, or Jameson Ferney (Advanced Markets Specialist) at 801-826-2601 or jameson.ferney@allegisag.com.